|

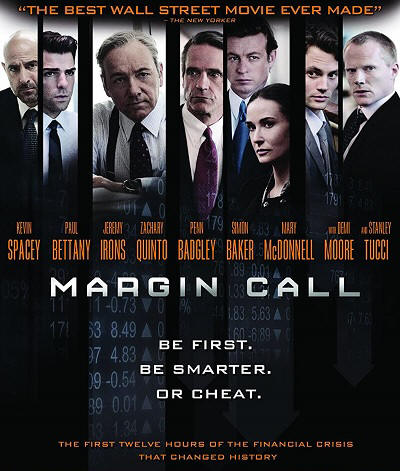

American Rhetoric: Movie Speech "Margin Call" (2011)

C-Level Emergency Meeting on the Company's Mortgage Securitzation Situation;

John Tuld: Please, sit down. Welcome, everyone. I must apologize for dragging you all here at such an uncommon hour. But from what I've been told, this matter needs to be dealt with urgently -- so urgently, in fact, it probably should have been addressed weeks ago. But that is spilt milk under the bridge. So, why doesn't somebody tell me what they think is going on here? Jared Cohen: Mr. Tuld, as I mentioned earlier, if you compare the figure at the top of page 13 -- Tuld: Jared, it's a little early for all that. Just speak to me in plain English. Cohen: Okay -- Tuld: In fact, I'd like to speak to the guy who put this together. Mr. Sullivan, is it? Does he speak English? Cohen: Sir? Tuld: I'd like to speak with the analyst who seems to have stumbled across this mess. Cohen: Certainly. That would be Peter Sullivan. Right here.

Tuld: Oh, Mr. Sullivan, you're here. Good morning. Maybe you could tell me what you think is going on here. And please, speak as you might to a young child or a golden retriever. It wasn't brains that got me here. I can assure you of that. Peter Sullivan: Well, uh...sir, as you may or may not know, I work, here, for Mr. Rogers as an associate in the Risk Assessment and Management Office at MBS. Tuld: Please. Just relax. Stand up. Tell us in a clear voice -- what is the nature of the problem? Sullivan: Okay, uh...Well, as you probably know, over the last 36 to 40 months the firm has begun packaging new MBS products that combine several different tranches of rating classification in one tradable security. This has been enormously profitable, as I imagine you noticed. Tuld: I have. Sullivan: Well, the firm is currently doing a considerable amount of this business every day. Now the problem, which is, I guess, why we are here tonight, is that it takes us -- the firm -- about a month to layer these products correctly, thereby posing a challenge from a risk management standpoint. Tuld: And, Mr. Sullivan, that challenge is? Sullivan: Well, we have to hold these assets on our books longer than we might ideally like to. Tuld: Yes. Sullivan: But the key factor here is, these are essentially just mortgages, so that has allowed us to push the leverage considerably beyond what you might be willing or allowed to do in any other circumstance, thereby pushing the risk profile without raising any red flags.

Tuld: Now -- thank you, Mr. Sullivan. Sit down. What I'm guessing your report here says -- and give me some rope here -- what I'm guessing it says is that considering the, shall we say, bumpy road we've been on the last week or so, that the figures your brilliant co-workers up the line ahead of you have come up with don't make much sense any more, considering what's taking place today. Sullivan: Actually, not what's taking place today, but what's already taken place over the last two weeks. Tuld: So, you're saying this has already happened. Sullivan: Sort of. Tuld: Sort of. And, Mr. Sullivan, what does your model say that that means for us here? Sullivan: Well, that's where it becomes a projection. But, um -- Tuld: You're speaking with me, Mr. Sullivan. Sullivan: Well, sir, if those assets decrease by just 25%, and remain on our books, that loss would be greater than the current market capitalization of this entire company.

Tuld: So, what you're telling me is that the music is about to stop, and we're going to be left holding the biggest bag of odorous excrement ever assembled in the history of...capitalism. Sullivan: Sir, I'm not sure that I would put it that way, but let me clarify. Using your analogy, what this model shows is the music, so to speak -- just slowing. If the music were to stop, as you put it, then this model wouldn't be even close to that scenario. It would be considerably worse.

Tuld: Let me tell you something, Mr. Sullivan. Do you care to know why I'm in this chair with you all? I mean, why I earn the big bucks? Sullivan: Yes. Tuld: I'm here for one reason and one reason alone. I'm here to guess what the music might do a week, a month, a year from now. That's it. Nothing more. And standing here tonight, I'm afraid that I don't hear a thing. Just...silence. So, now that we know the music has stopped, what can we do about it? Mr. Cohen? Ms Robertson. I'm afraid I think this is where you're supposed to step back in. Lord knows, we've relied enough on Mr. Sullivan tonight. What do you have for us? What have I told you since the first day you stepped into my office? There are three ways to make a living in this business: be first; be smarter; or cheat. Now, I don't cheat. And although I like to think we have some pretty smart people in this building, it sure is a hell of a lot easier to just be first.

Cohen: Sell it all. Today. Tuld: Is that even possible, Sam? Sam Rogers: Yes, but at what cost? Tuld: I'll have to pay. Rogers: Really? Tuld: I think so. Where is this going to come back to us? Rogers: Everywhere. Tuld: Sam, I don't think you seem to understand what your boy here has just said. If I made you, how would you do this? Rogers: Well, you call the traders in for their normal 6:30[am] meeting and you be honest with them -- because they're going to know it's the end either way. So, you're going to have to throw 'em a bone, and a pretty big one. And then you've got to come out of the gates storming. No swaps. No nothing. Forty percent done by 10:15. By 11:00 all your trades have to be gone, because by lunchtime word's going to be out. And by 2:00 you're going to be selling at 65 cents on the dollar, if you're lucky. And then the Feds are going to be in here, up your ass, trying to slow you down.

Tuld: Ramesh? Ramesh Shah: They can slow you down. But they can't stop you. It's yours to sell. Rogers: Yeah, but John, even if we manage to pull that off -- and that's saying something -- the real question is, who are we selling this to? Tuld: Same people we've been selling it to for the last two years, and whoever else will buy it. Rogers: But, John, if you do this, you will kill the market for years. It's over. And you're selling something that you know has no value. Tuld: We are selling to willing buyers at the current fair market price -- so that we may survive. Rogers: You will never sell anything to any of those people ever again. Tuld: I understand. Rogers: Do you? Tuld: Do you? This is it! I'm telling you! This is it! |

|

© Copyright 2001-Present. |